Proforma Invoice vs Commercial Invoice: What’s the Difference in International Trade

Quote from chief_editor on January 16, 2026, 7:45 amIn international trade, two documents are often confused, especially by SMEs and first-time importers: the Proforma Invoice and the Commercial Invoice. Although they look similar, they serve very different purposes and are used at different stages of a transaction.

Understanding the difference between these two documents is critical for payment, banking procedures, customs clearance, and internal compliance.

What a Proforma Invoice Is

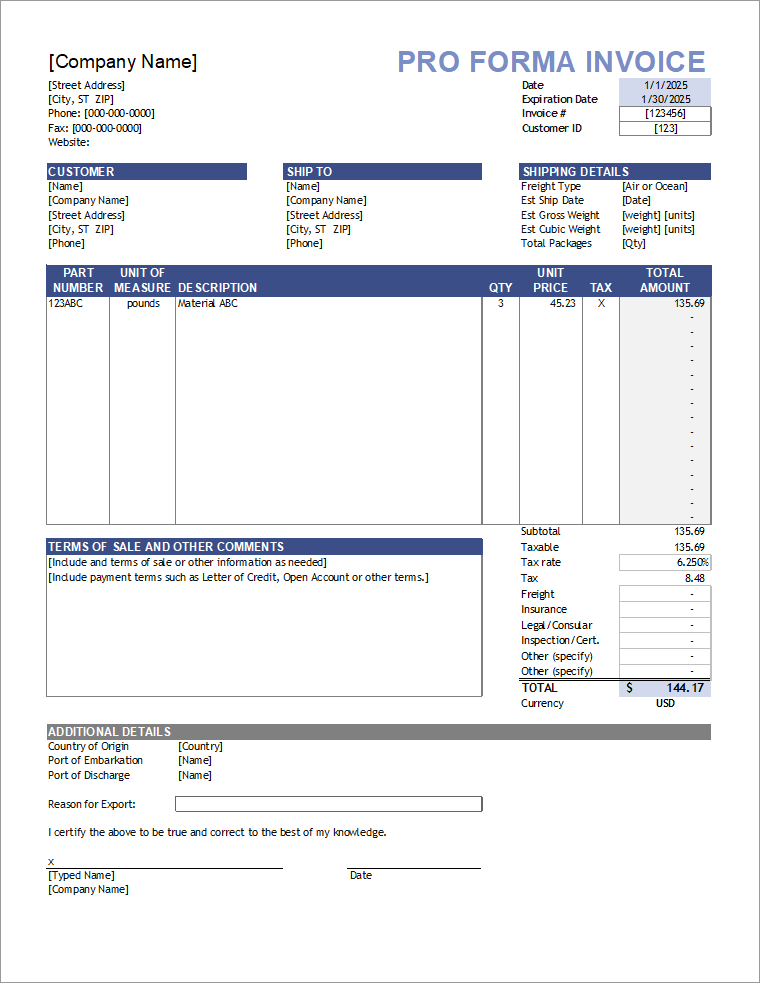

A Proforma Invoice is a pre-transaction document. It is essentially a seller’s formal quotation presented in an invoice-like format. It is usually issued before shipment and often before a definitive contract is fully executed.

In practice, a Proforma Invoice is commonly used for internal approvals, trade finance preparation, or regulatory applications.

Example – Equipment Trade

A Chinese equipment manufacturer plans to export an industrial system worth USD 3 million to a buyer in Southeast Asia. Before placing a firm order, the buyer requests a Proforma Invoice to submit internally for procurement approval and to its bank for opening a Letter of Credit.

At this stage, the equipment has not yet been manufactured or shipped. The Proforma Invoice outlines the expected specifications, pricing, Incoterms, payment method, and estimated delivery timeline. It helps the buyer move the transaction forward, but it does not represent a completed sale and cannot be used for customs clearance.

What a Commercial Invoice Is

A Commercial Invoice is a post-transaction document. It is the official invoice issued for customs declaration, final settlement, and accounting purposes. It reflects the actual shipment and the final agreed commercial terms.

Example – Energy / Commodity Trade

In an energy transaction, a trading company sells a cargo of crude oil to a refinery in China under a pricing formula linked to ICE Brent. Before the vessel arrives, the seller may issue a Proforma Invoice based on estimated quantity and provisional pricing so the buyer can prepare funds and internal approvals.

After discharge, once quantity and quality are confirmed by independent inspectors and the final pricing period is complete, the seller issues a Commercial Invoice. This invoice reflects the final quantity, final price, shipment details, and is used for customs declaration and final payment settlement.

When Each Document Is Used

A Proforma Invoice is typically used when the transaction is still being arranged, approved, or financed. It allows the buyer and its bank or regulators to understand the proposed deal structure.

A Commercial Invoice is issued once the transaction is executed or shipment details are finalized, and it becomes part of the mandatory customs and accounting documentation.

Key Differences That Matter in Practice

Stage of transaction

A Proforma Invoice appears before shipment and may contain estimated or provisional details.

A Commercial Invoice appears at or after shipment and reflects actual execution.Legal and operational role

A Proforma Invoice functions as a planning and approval document.

A Commercial Invoice functions as a formal trade document recognized by customs and financial authorities.Finality of information

A Proforma Invoice may be revised or replaced.

A Commercial Invoice should match the physical shipment and contract terms.Use with banks and customs

Banks frequently rely on Proforma Invoices for credit approval or trade finance preparation.

Customs authorities rely on Commercial Invoices for valuation and clearance.A Simple Rule of Thumb

If the deal is still being evaluated, approved, or financed, you are likely dealing with a Proforma Invoice.

If goods are shipped or being declared for import, you are dealing with a Commercial Invoice.Reference Note

This article is provided for general trade education purposes only. Document requirements may vary depending on jurisdiction, product type, contract terms, and banking arrangements. Parties should align their documentation with applicable laws and professional advice.

In international trade, two documents are often confused, especially by SMEs and first-time importers: the Proforma Invoice and the Commercial Invoice. Although they look similar, they serve very different purposes and are used at different stages of a transaction.

Understanding the difference between these two documents is critical for payment, banking procedures, customs clearance, and internal compliance.

What a Proforma Invoice Is

A Proforma Invoice is a pre-transaction document. It is essentially a seller’s formal quotation presented in an invoice-like format. It is usually issued before shipment and often before a definitive contract is fully executed.

In practice, a Proforma Invoice is commonly used for internal approvals, trade finance preparation, or regulatory applications.

Example – Equipment Trade

A Chinese equipment manufacturer plans to export an industrial system worth USD 3 million to a buyer in Southeast Asia. Before placing a firm order, the buyer requests a Proforma Invoice to submit internally for procurement approval and to its bank for opening a Letter of Credit.

At this stage, the equipment has not yet been manufactured or shipped. The Proforma Invoice outlines the expected specifications, pricing, Incoterms, payment method, and estimated delivery timeline. It helps the buyer move the transaction forward, but it does not represent a completed sale and cannot be used for customs clearance.

What a Commercial Invoice Is

A Commercial Invoice is a post-transaction document. It is the official invoice issued for customs declaration, final settlement, and accounting purposes. It reflects the actual shipment and the final agreed commercial terms.

Example – Energy / Commodity Trade

In an energy transaction, a trading company sells a cargo of crude oil to a refinery in China under a pricing formula linked to ICE Brent. Before the vessel arrives, the seller may issue a Proforma Invoice based on estimated quantity and provisional pricing so the buyer can prepare funds and internal approvals.

After discharge, once quantity and quality are confirmed by independent inspectors and the final pricing period is complete, the seller issues a Commercial Invoice. This invoice reflects the final quantity, final price, shipment details, and is used for customs declaration and final payment settlement.

When Each Document Is Used

A Proforma Invoice is typically used when the transaction is still being arranged, approved, or financed. It allows the buyer and its bank or regulators to understand the proposed deal structure.

A Commercial Invoice is issued once the transaction is executed or shipment details are finalized, and it becomes part of the mandatory customs and accounting documentation.

Key Differences That Matter in Practice

Stage of transaction

A Proforma Invoice appears before shipment and may contain estimated or provisional details.

A Commercial Invoice appears at or after shipment and reflects actual execution.

Legal and operational role

A Proforma Invoice functions as a planning and approval document.

A Commercial Invoice functions as a formal trade document recognized by customs and financial authorities.

Finality of information

A Proforma Invoice may be revised or replaced.

A Commercial Invoice should match the physical shipment and contract terms.

Use with banks and customs

Banks frequently rely on Proforma Invoices for credit approval or trade finance preparation.

Customs authorities rely on Commercial Invoices for valuation and clearance.

A Simple Rule of Thumb

If the deal is still being evaluated, approved, or financed, you are likely dealing with a Proforma Invoice.

If goods are shipped or being declared for import, you are dealing with a Commercial Invoice.

Reference Note

This article is provided for general trade education purposes only. Document requirements may vary depending on jurisdiction, product type, contract terms, and banking arrangements. Parties should align their documentation with applicable laws and professional advice.

Uploaded files: