SCO / FCO / ICPO Explained: How Real Commodity Deals Actually Start

Quote from chief_editor on January 16, 2026, 8:10 amIn international commodity and energy trade, three documents are frequently mentioned but often misunderstood: SCO (Soft Corporate Offer), FCO (Full Corporate Offer), and ICPO (Irrevocable Corporate Purchase Order).

They are not contracts. They are not shipping documents.

They are signals — signals of intent, seriousness, and readiness at different stages of a deal.Understanding how these documents work together is critical for avoiding wasted time, false deals, and common trade scams.

What SCO Really Means in Practice

SCO stands for Soft Corporate Offer. Despite how it sounds, it is not a commitment to sell.

In real trade practice, an SCO is a market-testing document. It tells the buyer and intermediaries:

“This seller claims they can supply this product under roughly these conditions.”An SCO usually appears early, when:

The seller is testing price levels

The seller does not want to lock terms

The buyer has not yet proven capability

Intermediaries are still matching parties

Typical SCO content includes:

Product type (e.g. crude oil, diesel, coal)

Approximate quantity

Indicative pricing idea (e.g. Brent – X)

Indicative Incoterms

Short validity

Example – SCO in Energy Trade

A trading company circulates an SCO stating availability of 1 million barrels of crude oil, priced at “ICE Brent minus a negotiable differential, FOB basis”. No documents are attached, no signatures are given.

At this stage, nothing has been verified. The SCO is simply a signal: “We may have access to supply.”

What FCO Actually Changes

FCO stands for Full Corporate Offer. This is where many misunderstandings start.

An FCO is not a contract, but it is a serious corporate statement. It usually means the seller is prepared to proceed, subject to buyer confirmation and formal contracting.

In practice, an FCO signals that:

The seller is naming itself officially

Core commercial terms are fixed (or conditionally fixed)

The seller expects buyer-side documents next

A proper FCO normally includes:

Seller’s full corporate details

Product specifications

Quantity and delivery schedule

Pricing formula

Payment method

Required buyer documents (ICPO, KYC, bank comfort, etc.)

Validity period

Authorized signature

Example – FCO in Commodity Trade

After reviewing buyer credentials, the seller issues an FCO offering a fixed monthly quantity of energy product, priced against a published index, with DAP delivery and defined payment terms.

At this point, the seller is saying:

“These are the terms under which we are ready to sell, if you are ready to proceed.”Why ICPO Is the Real Gatekeeper

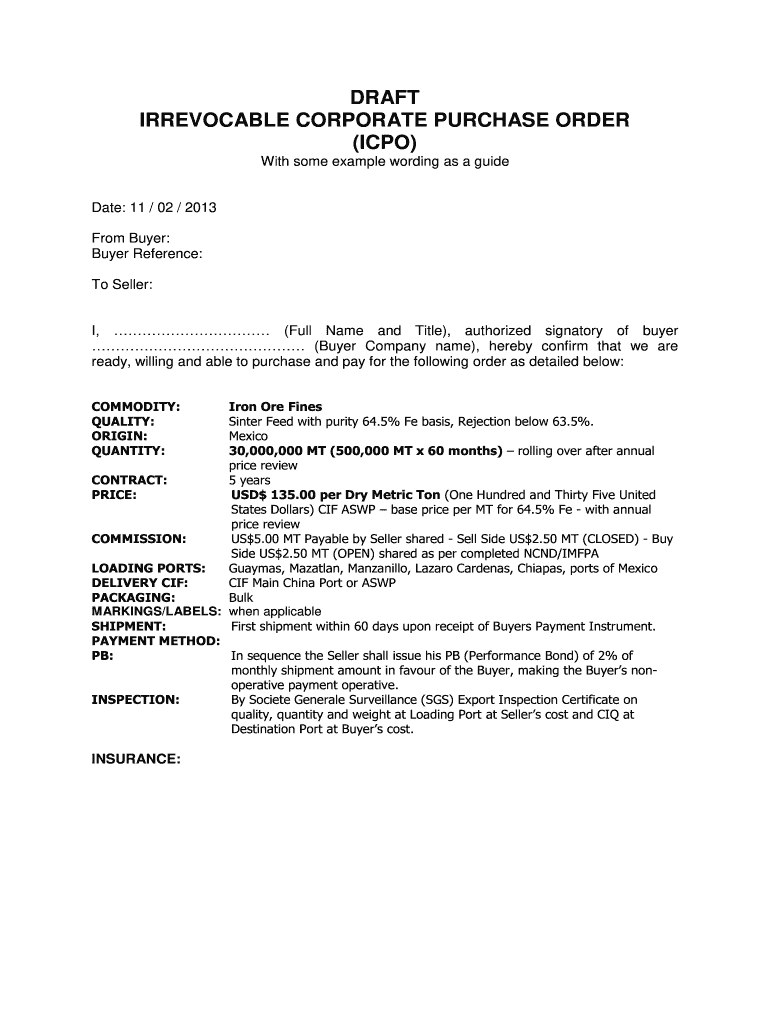

ICPO stands for Irrevocable Corporate Purchase Order. Despite the word “irrevocable”, it is still not the final contract.

However, ICPO is the buyer’s seriousness test.

An ICPO tells the seller:

“I am a real buyer, I accept your commercial terms in principle, and I am prepared to move forward.”In real deals, ICPO is used to:

Filter out non-performing buyers

Trigger internal seller approvals

Start compliance, allocation, or scheduling

An ICPO typically includes:

Buyer’s full corporate details

Acceptance of FCO terms

Requested quantity

Delivery details

Payment capability statement

Authorized signature

Example – ICPO in Practice

A refinery or trading company submits an ICPO confirming acceptance of the FCO pricing formula, delivery terms, and payment structure, subject only to execution of SPA.

Only after receiving this ICPO does the seller usually commit resources to drafting the Sales and Purchase Agreement.

How These Documents Fit Together

A simplified and realistic flow looks like this:

SCO → Market testing

FCO → Seller commitment signal

ICPO → Buyer commitment signal

SPA → Legal contract

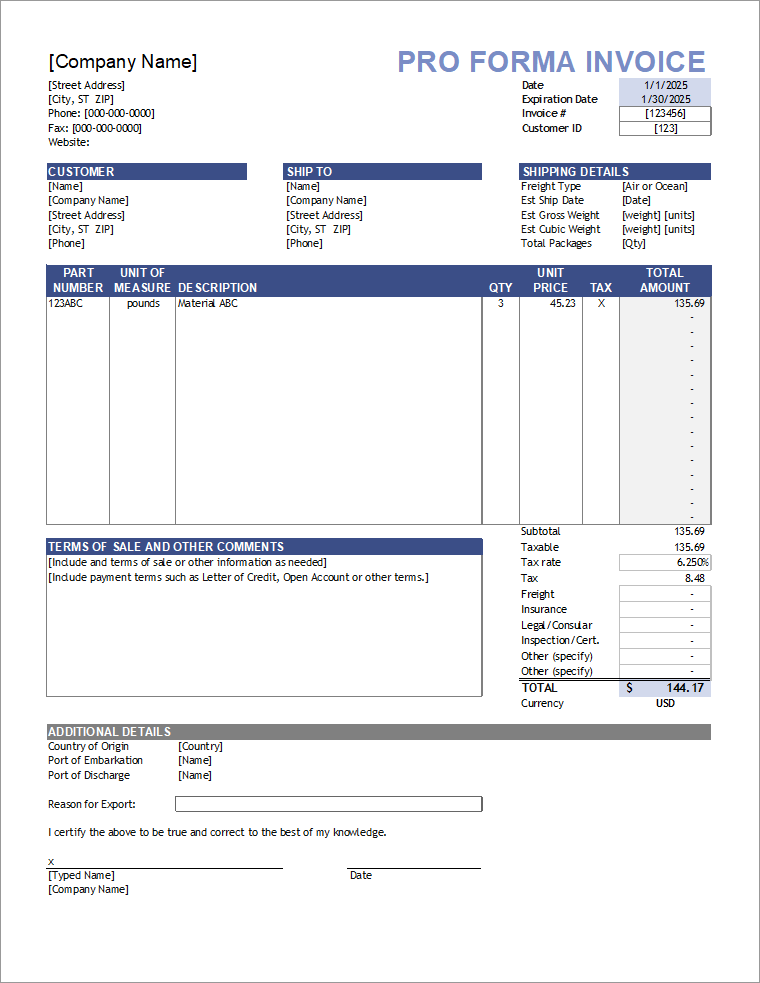

Proforma Invoice → Payment preparation

Commercial Invoice → Final settlement and customsNot every deal follows every step, but skipping steps usually increases risk.

Common Misunderstandings and Red Flags

An SCO does not mean the seller has guaranteed supply

An FCO does not mean a deal is closed

An ICPO without company authority is meaningless

Anyone asking for fees before ICPO or SPA is a red flag

In real commodity markets, these documents are about filtering seriousness, not legal enforcement.

A Practical Rule of Thumb

If you only see SCOs, the deal is still hypothetical.

If an FCO is issued, the seller is watching closely.

If an ICPO is requested, the seller expects proof of capability.

Only an SPA creates enforceable obligations.Reference Note

This article reflects common industry practice in international commodity and energy trade. Actual document requirements, legal effects, and enforceability depend on jurisdiction, contract structure, and counterparty arrangements.

In international commodity and energy trade, three documents are frequently mentioned but often misunderstood: SCO (Soft Corporate Offer), FCO (Full Corporate Offer), and ICPO (Irrevocable Corporate Purchase Order).

They are not contracts. They are not shipping documents.

They are signals — signals of intent, seriousness, and readiness at different stages of a deal.

Understanding how these documents work together is critical for avoiding wasted time, false deals, and common trade scams.

What SCO Really Means in Practice

SCO stands for Soft Corporate Offer. Despite how it sounds, it is not a commitment to sell.

In real trade practice, an SCO is a market-testing document. It tells the buyer and intermediaries:

“This seller claims they can supply this product under roughly these conditions.”

An SCO usually appears early, when:

-

The seller is testing price levels

-

The seller does not want to lock terms

-

The buyer has not yet proven capability

-

Intermediaries are still matching parties

Typical SCO content includes:

-

Product type (e.g. crude oil, diesel, coal)

-

Approximate quantity

-

Indicative pricing idea (e.g. Brent – X)

-

Indicative Incoterms

-

Short validity

Example – SCO in Energy Trade

A trading company circulates an SCO stating availability of 1 million barrels of crude oil, priced at “ICE Brent minus a negotiable differential, FOB basis”. No documents are attached, no signatures are given.

At this stage, nothing has been verified. The SCO is simply a signal: “We may have access to supply.”

What FCO Actually Changes

FCO stands for Full Corporate Offer. This is where many misunderstandings start.

An FCO is not a contract, but it is a serious corporate statement. It usually means the seller is prepared to proceed, subject to buyer confirmation and formal contracting.

In practice, an FCO signals that:

-

The seller is naming itself officially

-

Core commercial terms are fixed (or conditionally fixed)

-

The seller expects buyer-side documents next

A proper FCO normally includes:

-

Seller’s full corporate details

-

Product specifications

-

Quantity and delivery schedule

-

Pricing formula

-

Payment method

-

Required buyer documents (ICPO, KYC, bank comfort, etc.)

-

Validity period

-

Authorized signature

Example – FCO in Commodity Trade

After reviewing buyer credentials, the seller issues an FCO offering a fixed monthly quantity of energy product, priced against a published index, with DAP delivery and defined payment terms.

At this point, the seller is saying:

“These are the terms under which we are ready to sell, if you are ready to proceed.”

Why ICPO Is the Real Gatekeeper

ICPO stands for Irrevocable Corporate Purchase Order. Despite the word “irrevocable”, it is still not the final contract.

However, ICPO is the buyer’s seriousness test.

An ICPO tells the seller:

“I am a real buyer, I accept your commercial terms in principle, and I am prepared to move forward.”

In real deals, ICPO is used to:

-

Filter out non-performing buyers

-

Trigger internal seller approvals

-

Start compliance, allocation, or scheduling

An ICPO typically includes:

-

Buyer’s full corporate details

-

Acceptance of FCO terms

-

Requested quantity

-

Delivery details

-

Payment capability statement

-

Authorized signature

Example – ICPO in Practice

A refinery or trading company submits an ICPO confirming acceptance of the FCO pricing formula, delivery terms, and payment structure, subject only to execution of SPA.

Only after receiving this ICPO does the seller usually commit resources to drafting the Sales and Purchase Agreement.

How These Documents Fit Together

A simplified and realistic flow looks like this:

SCO → Market testing

FCO → Seller commitment signal

ICPO → Buyer commitment signal

SPA → Legal contract

Proforma Invoice → Payment preparation

Commercial Invoice → Final settlement and customs

Not every deal follows every step, but skipping steps usually increases risk.

Common Misunderstandings and Red Flags

-

An SCO does not mean the seller has guaranteed supply

-

An FCO does not mean a deal is closed

-

An ICPO without company authority is meaningless

-

Anyone asking for fees before ICPO or SPA is a red flag

In real commodity markets, these documents are about filtering seriousness, not legal enforcement.

A Practical Rule of Thumb

If you only see SCOs, the deal is still hypothetical.

If an FCO is issued, the seller is watching closely.

If an ICPO is requested, the seller expects proof of capability.

Only an SPA creates enforceable obligations.

Reference Note

This article reflects common industry practice in international commodity and energy trade. Actual document requirements, legal effects, and enforceability depend on jurisdiction, contract structure, and counterparty arrangements.

Uploaded files: